For GST-registered businesses to view or update contact information such as GST mailing address and to subscribe to email alert services for GST e-Filing reminder and GST Bulletins. The return must be submitted regardless of whether there is any tax to be paid or not.

Malaysia Sst Sales And Service Tax A Complete Guide

Goods and Services Tax.

. Submission 5 minutes Processing. Income tax return for individual with business income income other than employment income Deadline. More 38.

Filing can be done either by post or online. Income tax return for individual who only received employment income. After the return submission in the same portal the payment is made via FPX facility with 17 banks to choose from.

Due date for filing and payment. Your entitys tax reference or GST registration number eg. GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer.

The deadline for GST filing GST Returns and payment of GST is the last day of the month following the taxable period. Last submission and payment date for gst 03 Please be informed that all GST registrants are required to submit the GST-03 Return and make full payment for the amount of tax payable in connection with the supply for the last taxable. GST Guide on Tax Invoice Debit Note Credit Note and Retention Payment After 1 September 2018.

The Goods and Services Tax GST is an abolished value-added tax in Malaysia. The submission of this final GST return fell on 28 December 2018. Deadline for filing of the GST Returns and payment of GST is the last day of the month following the taxable period.

Segala maklumat sedia ada adalah untuk rujukan sahaja. Input tax credit mechanism. LAPORKAN PENDAPATAN TAHUN TAKSIRAN 2021 SELEWAT-LEWATNYA PADA 15 MEI 2022 DAN ELAK PENALTI LEWAT KEMUKA BORANG NYATA CUKAI.

Both GST returns and payment are due one month after the end of the accounting period covered by the return. The existing standard rate for GST effective from 1 April 2015 is 6. The GST returns submission deadline for monthly returns had to be delayed from 31 May to 14 June 2015.

Malaysia Sales Service Tax - SST was re-introduced on 1 Sep 2018. By 29 December 2018. If you are on GIRO plan for GST payment GIRO deductions are on the 15th day of the month after the payment due date.

Tax payable under an assessment upon submission of a tax return is due and payable by the last day of the seventh month from the date of closing of accounts. This guide covers everything you need to know about Sales and Service Tax in Malaysia as a small business owner. Personal income tax PIT due dates.

Personal income tax PIT rates. SST-02 SST-02A Return Manual Submission More 49 28102020 Sales Tax Service Tax Guide on Return Payment More 50 14102020. Please note that payments are due on the same deadline and it can be paid via bank transfer.

Also the MIRB has closed all its office premises until 14 April 2020. SST return has to be submitted not later than the last day of the following month after the taxable period ended. Importation of goods is also subject to GST at standard-rated 0.

VAT in Malaysia known as Sales and Service Tax SST was introduced on September 1 2018 in order to replace GST Goods and Services TaxThe fixed rate is 6 and some types of goods and services can be exempt from this tax while others are taxed at different rates. The Royal Malaysian Customs Department Customs had previously issued the following Guides on matters relating to GST adjustments and declarations after 1 September 2018. 1003041 Block J Jaya One No.

Report all supplies made in the last taxable period and pay the GST due and payable relating to those supplies. Income tax return for partnership. Audit Assurance and Taxation Services in Malaysia.

Corporate income tax CIT due dates. Businesses are allowed to claim whatever amount of GST paid on the business inputs by offsetting against the output tax. What does the MOF statement dated 16 May 2018 relate to the imposition of GST at 0 and its impact on GST.

PwC Malaysia 60 3 2173 1469. Lembaga Hasil Dalam Negeri Malaysia HASiL ingin memberikan peringatan kepada semua pembayar cukai yang tidak menjalankan perniagaan agar segera melaporkan pendapatan mereka yang layak dikenakan. 30042022 15052022 for e-filing 5.

Companies have to declare SST return SST-01 every 2 months bi-monthly according to the taxable period. All supplies of goods and services which are now subject to GST at standard-rated 6 becomes standard-rated 0 effective on 01 June 2018. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy.

Aware and understand the various Exemption Benefits and Facilities available in SST. Remisi Penalti GagalLewat Bayar Dibawah Akta GST 2014. Submission GST-03 Return for Final Taxable Period.

The return can be submitted through. Crowe Malaysia PLT is the 5th largest accounting firm in Malaysia and. 200312345A or M90312345A Your Singpass.

Update GST Contact Details. More 37 09042021 Report To Be Prepared For Exemption under AMES. Malaysian GST was introduced from 1 March 2015 to replace the existing Goods and Services taxes which were both 6.

The Malaysian Inland Revenue Board MIRB has set out a new timetable for certain personal tax filing and employer compliance obligations including due date extensions in light of the COVID-19 crisis. Businesses have to charge and collect GST on all taxable goods and services supplied to the consumers. Claim input tax that was not claimed before 1 September 2018this is considered the final opportunity to claim input tax.

Only businesses registered under GST can charge and collect GST. The new GST is also 6 but the base of the tax has been widely extended to help stabilize future government revenues and. The deadline for the return is no later than 120 days after 1 September 2018 ie.

Objective of Understanding Malaysian Sales and Service Tax training. That means any GST return is due within 30 days of the end of the reporting period. Jabatan Kastam Diraja Malaysia Kompleks.

Clarified when the deadline came around. Value-added tax VAT rates. Understand the different between GST and SST and the impact on your business.

Aware of SST taxable period and returns submission deadline. Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018. GST Guide on Declaration and Adjustment After 1 September 2018.

Example if the taxable period is January to March then the deadline for filing and GST payment shall be 30 April. The one hundred and twenty 120 days period allocated by the. Malaysia Various Tax Deadlines Extended Due.

Please be informed that pursuant to Section 6 Goods and Service Tax Repeal Act 2018 all GST Registrants are required to submit the GST-03 Return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 120 days from 01092018. You may refer to your acknowledgement page for payment details after you have filed. 30062022 15072022 for e-filing 6.

Extension Of Deadline 2 Months For Filing Malaysia Income Tax 2020

Preparing Vat Returns And Gst Returns Xero Blog

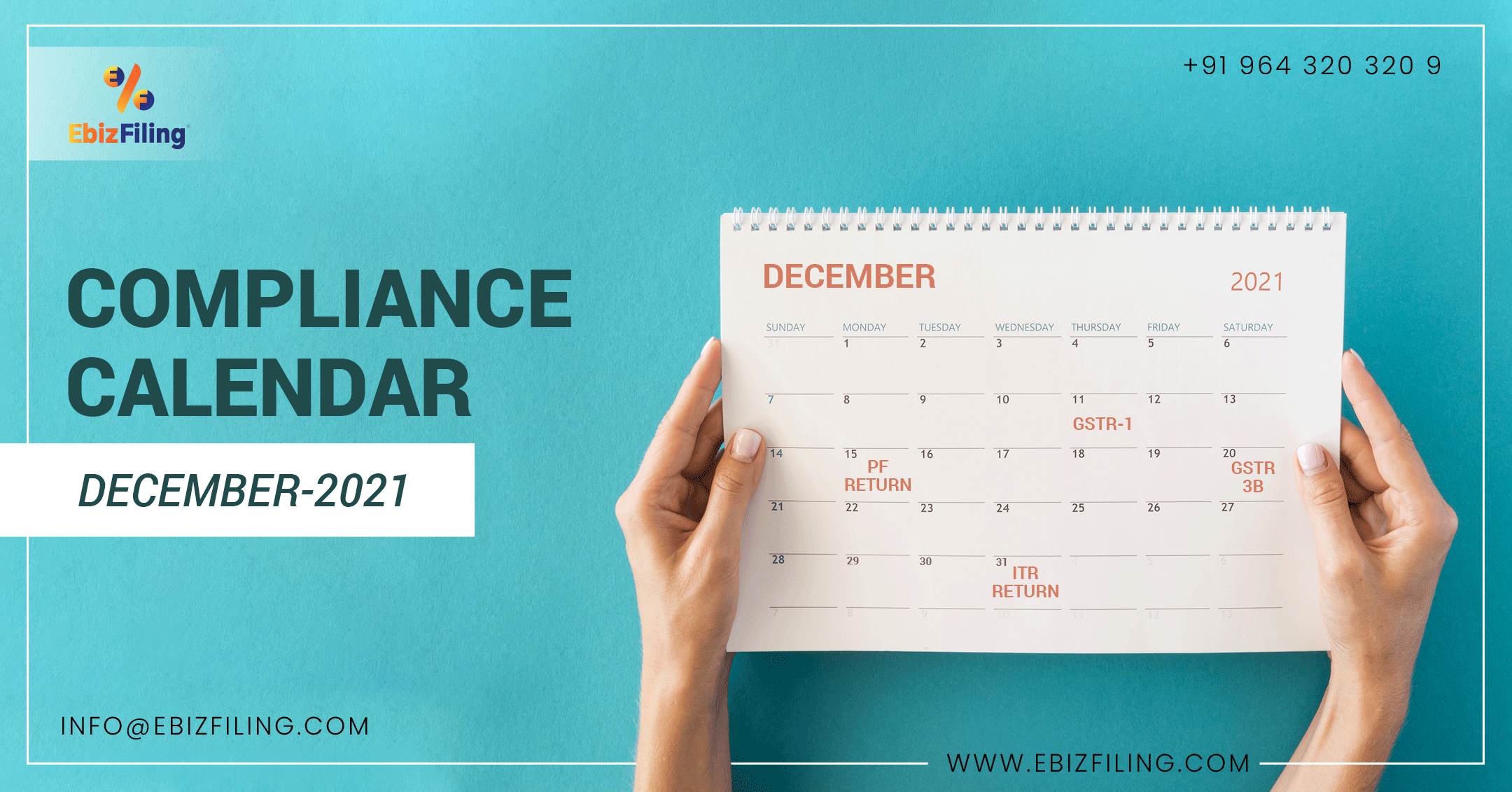

Tax Compliance And Statutory Due Dates For The Month Of December 2021

𝗧𝗮𝘅 𝗳𝗶𝗹𝗶𝗻𝗴 𝗗𝗲𝗮𝗱𝗹𝗶𝗻𝗲𝘀 𝗳𝗼𝗿 𝟮𝟬𝟮𝟭 Ks Chia Associates פייסבוק

Gst Return Late Fees Interest On Gstr Late Payment

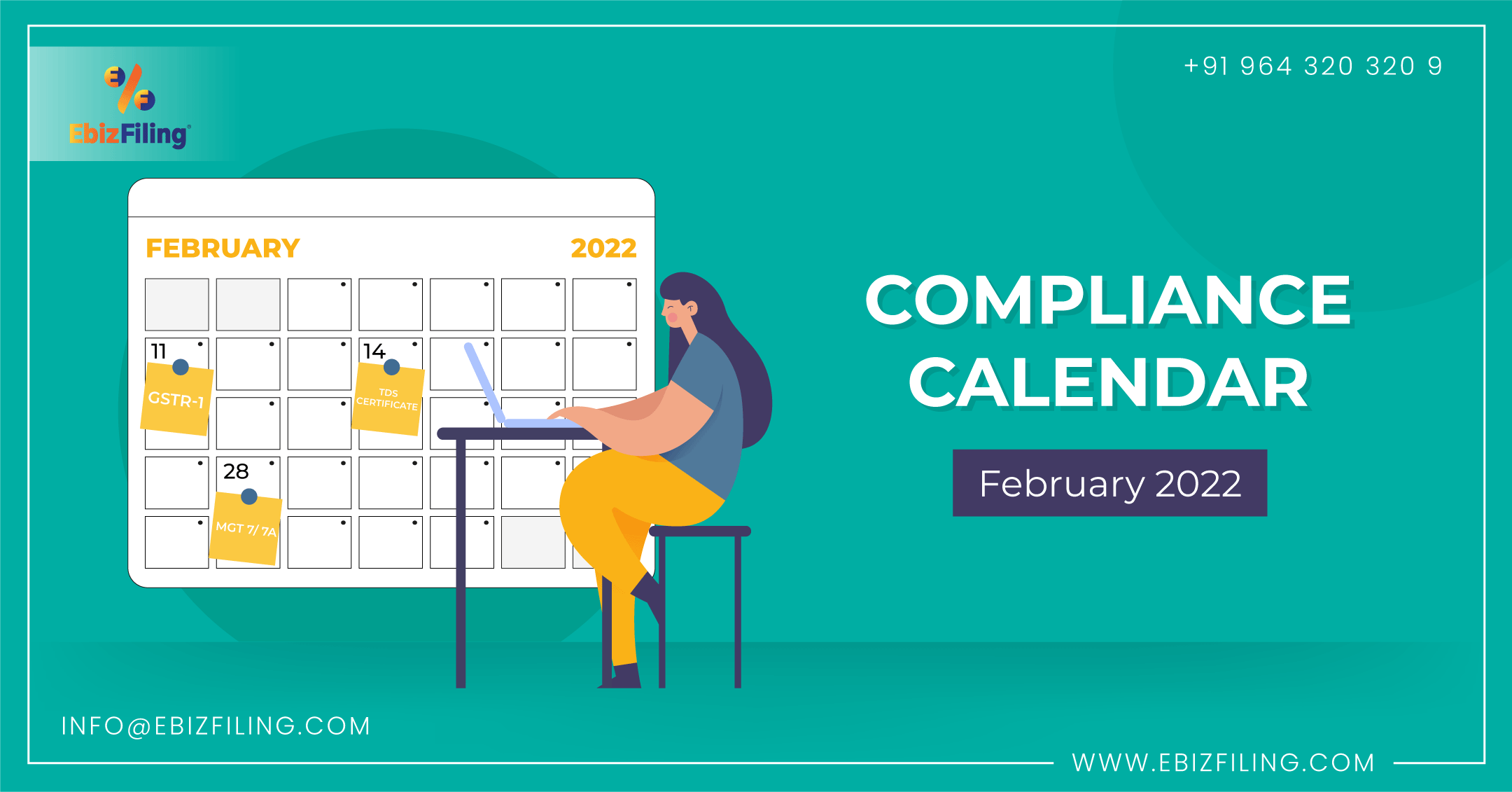

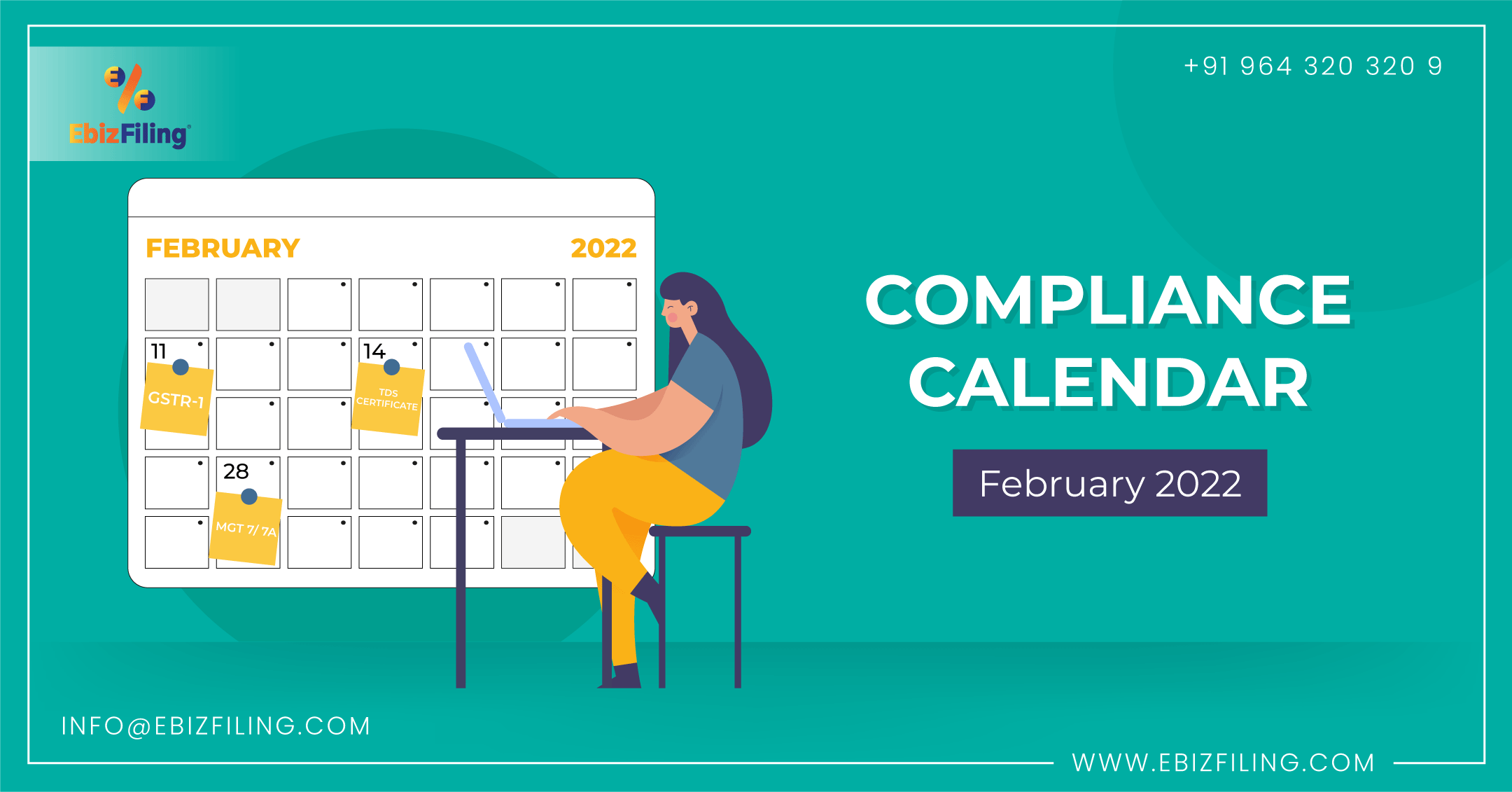

Tax Compliance And Statutory Due Dates For February 2022 Ebizfiling

Tax Filing Deadline 2022 Malaysia

Tax Compliance And Statutory Due Dates For April 2022 Ebizfiling

Monthly Gst Filing In Malaysia Goods And Services Tax Gst

Monthly Gst Filing In Malaysia Goods And Services Tax Gst

Gst Requirements Penalties In Malaysia Klm Group Accounting Company Secretarial Taxation Audit Kuala Lumpur

Tax Compliance And Statutory Due Dates For The Month Of November 2021

Tax Compliance And Statutory Due Dates For The Month Of March 2021

Gst Submission Deadline Malaysia Madalynngwf

Iras Overview Of Gst E Filing Process

India Gst What Are The Different Types Of Gst Returns

Only 20 Of Gst Returns For Fy18 Filed A2z Taxcorp Llp